Composite Hose,Composite Cryogenic Hose,Flexible Composite Hoses,Composite Chemical Hose Hebei no one but god energy equipment co.,ltd , https://www.p-harcourtbrothers.com

Turkey Adjusts Import Customs Duty Rates-DHL

Since **August 21, 2024**, the **Turkish Ministry of Finance** has implemented significant changes to **customs duty thresholds for B2C imports** and the **VAT rate for shipments entering Turkey from the EU and other regions worldwide**. These updates are essential for both shippers and recipients to understand in order to avoid delays and additional costs.

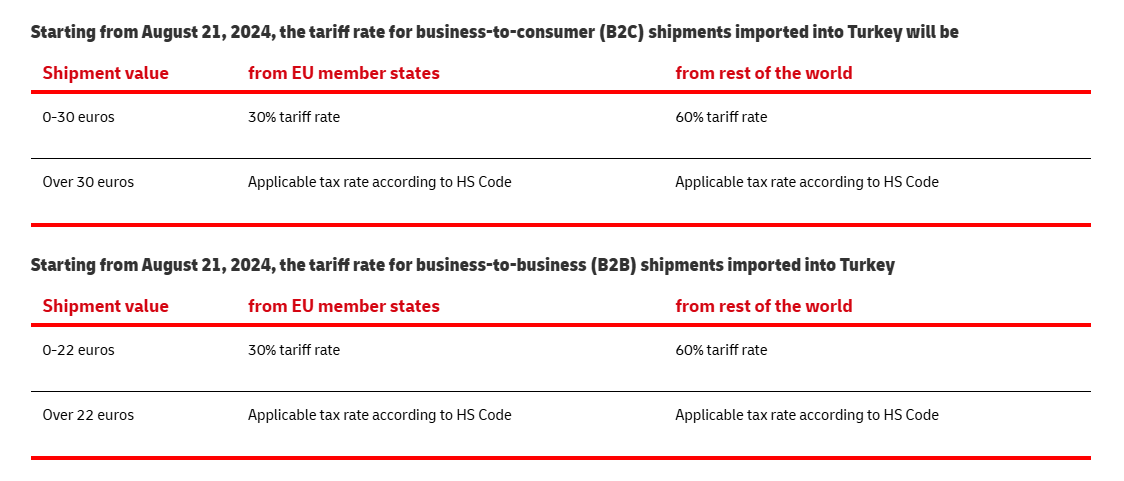

1. **The customs duty threshold** for business-to-consumer (B2C) import shipments **has been lowered from €150 to €30**. This means that more packages will now be subject to customs duties, especially those coming from outside the EU.

2. **Tariff rates** for imported shipments have also been adjusted:

- **EU Member States**: The tariff rate **increases from 20% to 30%**.

- **Rest of the World**: The tariff rate **rises from 30% to 60%**.

*EU Member States include: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, and Sweden.*

**DHL Reminders:**

- **Medicines** imported into Turkey are subject to a **higher threshold of €1,500**.

- For **shipments valued above €30**, **official confirmation from the recipient is required** for customs clearance, and **additional fees may apply**.

**Tips for Shippers to Avoid Delays:**

- Ensure all **shipment details are accurate and complete**, including the **correct value of the goods**.

- Provide **electronic commercial invoices** through DHL Express’s digital shipping solutions. Include **product descriptions, itemized values, and country of origin**.

- When sending B2C shipments via DHL, **include the recipient's mobile number and email address in Turkey** so DHL can contact them if needed for customs clearance.

- If you do not want DHL to contact the recipient (e.g., for DTP billing), provide an **alternative contact email**.

- **Inform your customers about potential customs fees**, as **shipments cannot be delivered until duties are paid**.

**Tips for Recipients in Turkey:**

- You will receive a **notification from DHL**. You must **choose DHL as your customs broker** or provide an **alternative customs broker** for clearance.

- DHL sends a notification for each shipment, as **customs broker information is not stored in the customer's master file**.

- It is important to **respond promptly** and provide clear instructions to DHL.

- Customs clearance can only proceed once **you authorize DHL to act as the customs broker** or provide an alternative one.

- If no authorization or alternative broker is provided within **20 days of the shipment arriving**, the package may be **held at Turkish Customs** and eventually **returned to the sender**.

For more detailed information, please visit the **official website of the Turkish Ministry of Finance**.

If you're interested in learning more about how these changes affect your shipments, feel free to reach out to our support team or consult with your local DHL representative. Stay informed, stay prepared, and ensure smooth delivery for your international shipments.